Crisis and Opportunity

“Everyone Breaks.”

Having worked on a number of large California projects, I wanted to to add a section to discuss the unique opportunity emerging from the current housing crisis on the West Coast. As many “development friendly” markets deal with the post-covid wave of supply shock, there is no other region with more immediate opportunity for housing development .

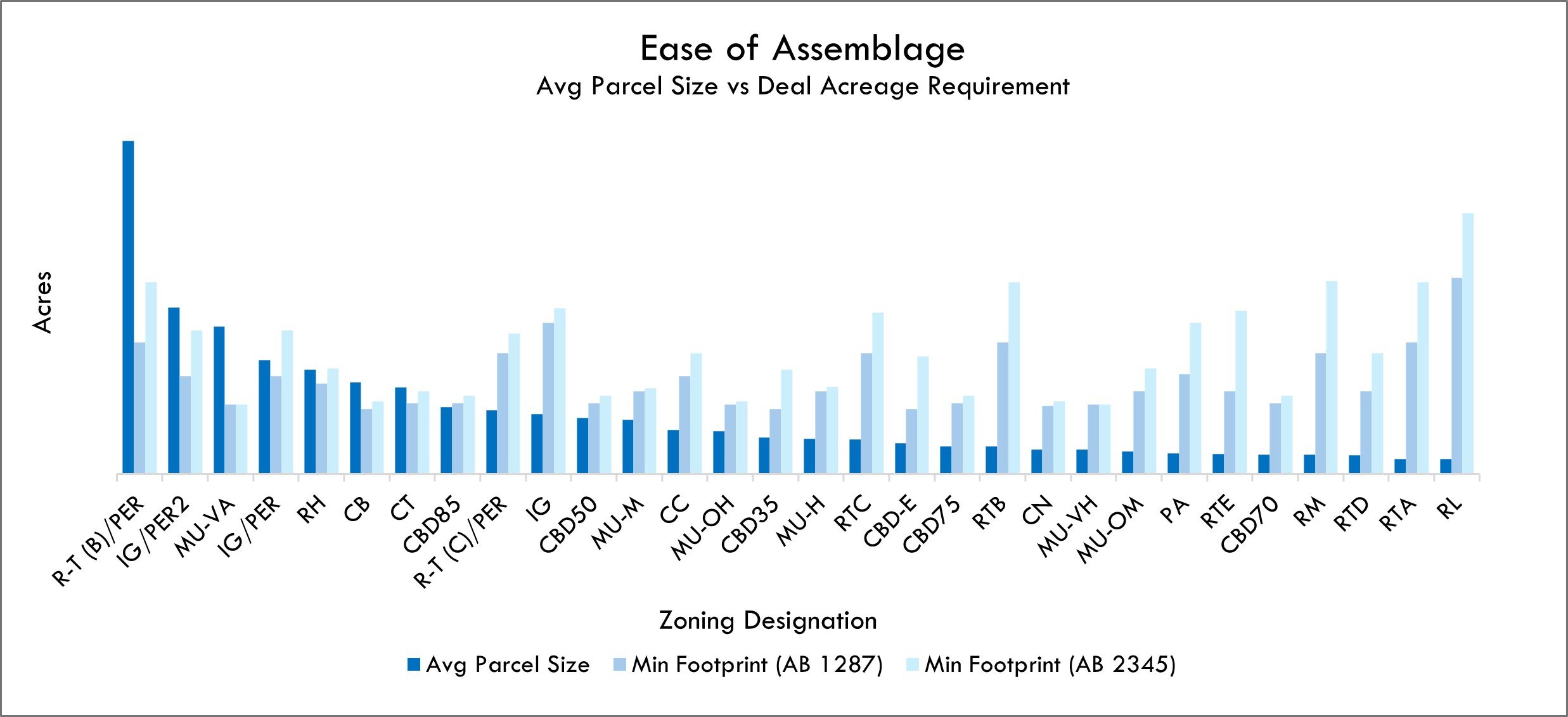

Considered unnecessarily risky and complex by many national investment teams, the state of California has gone to extreme lengths since 2019 to stimulate housing development by producing legislative initiatives that incentivize and protect developers. After years of refinement, density is finally being generated in highly desirable NIMBY markets that have long been known to torpedo large projects and cost developers millions.

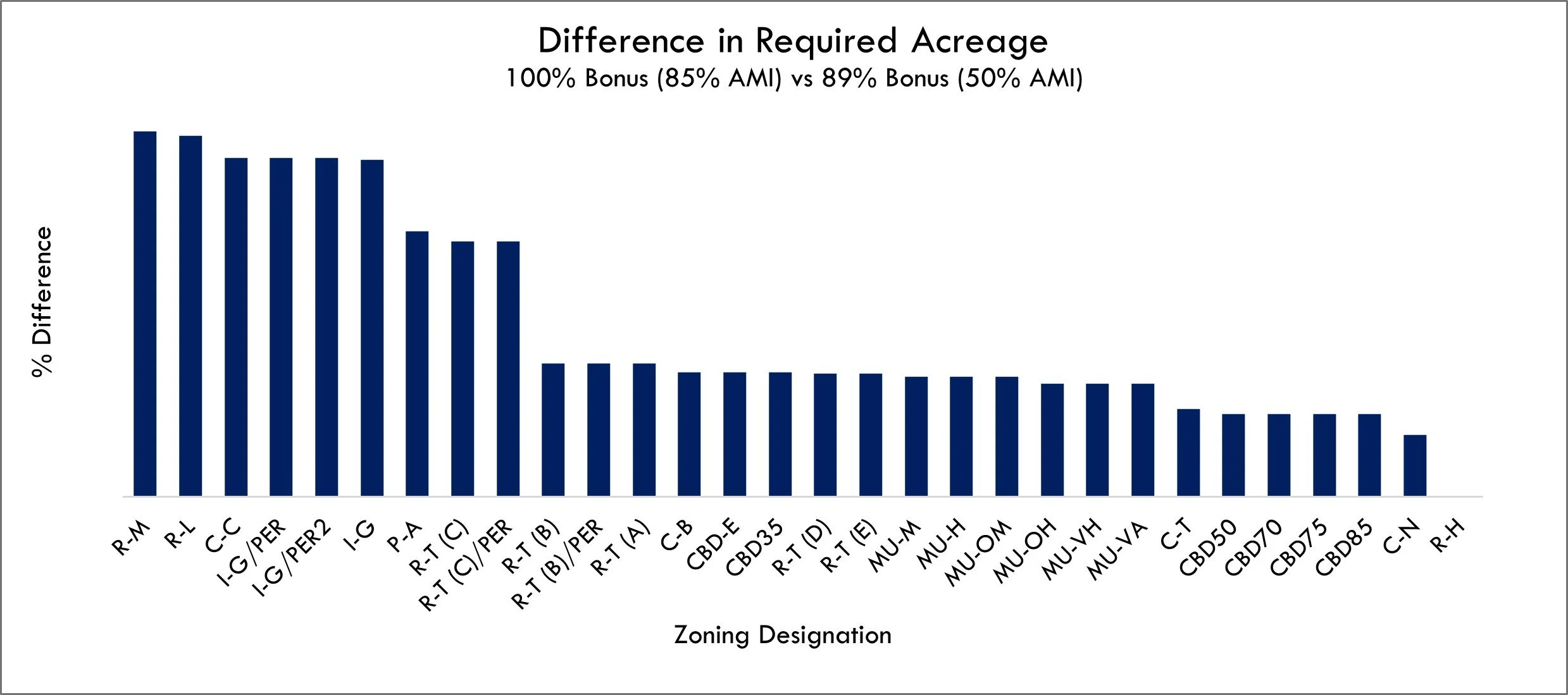

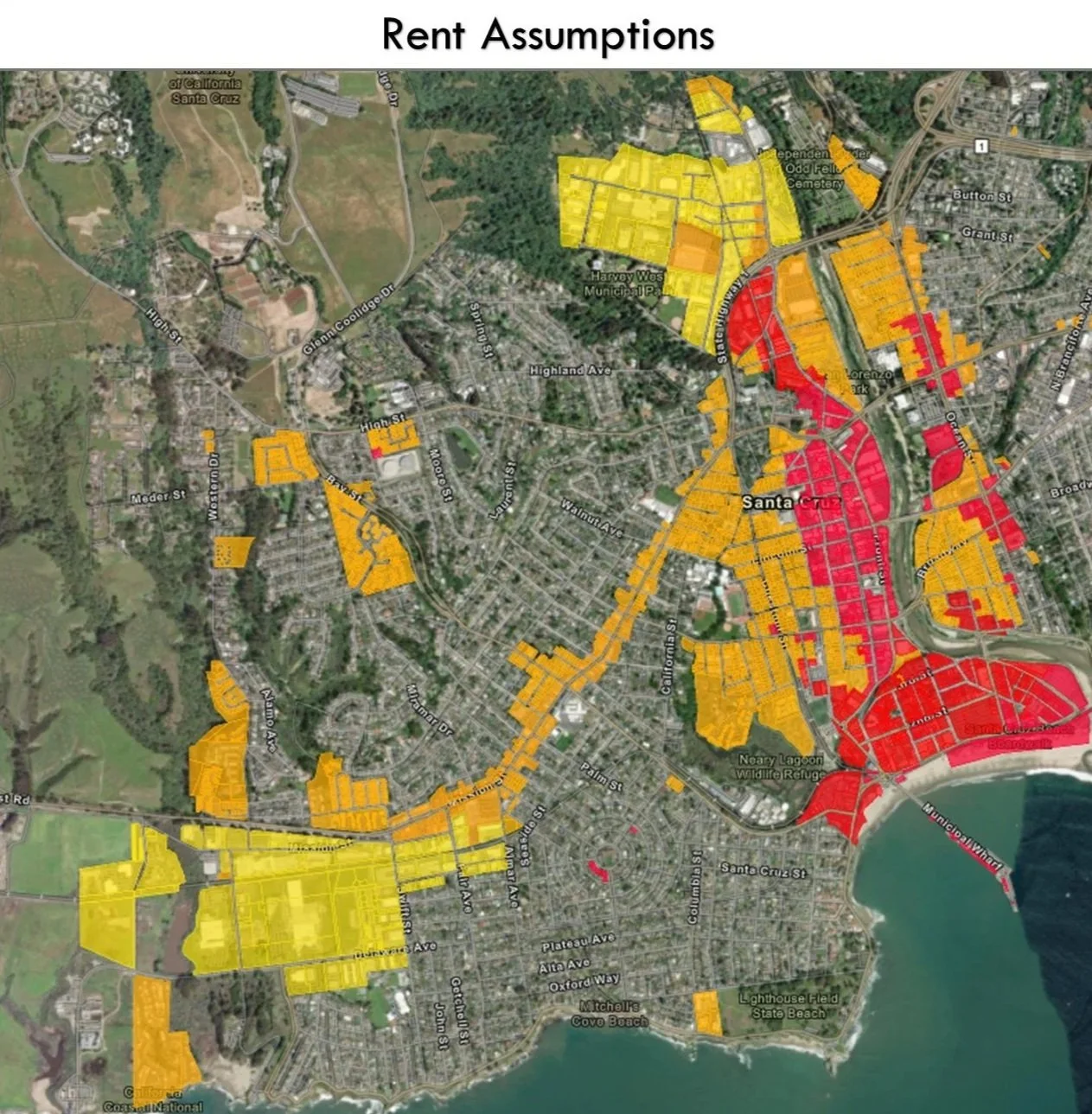

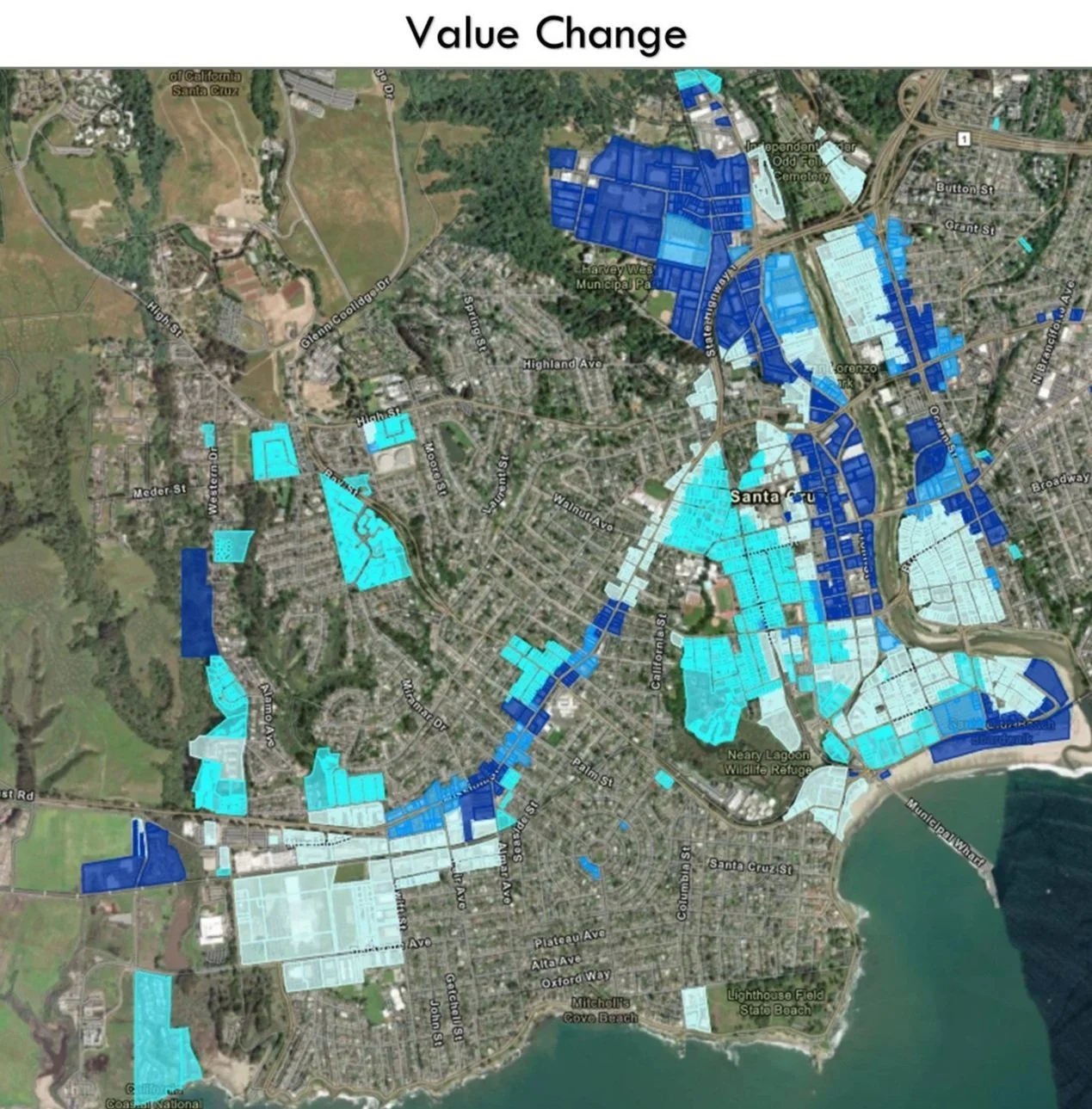

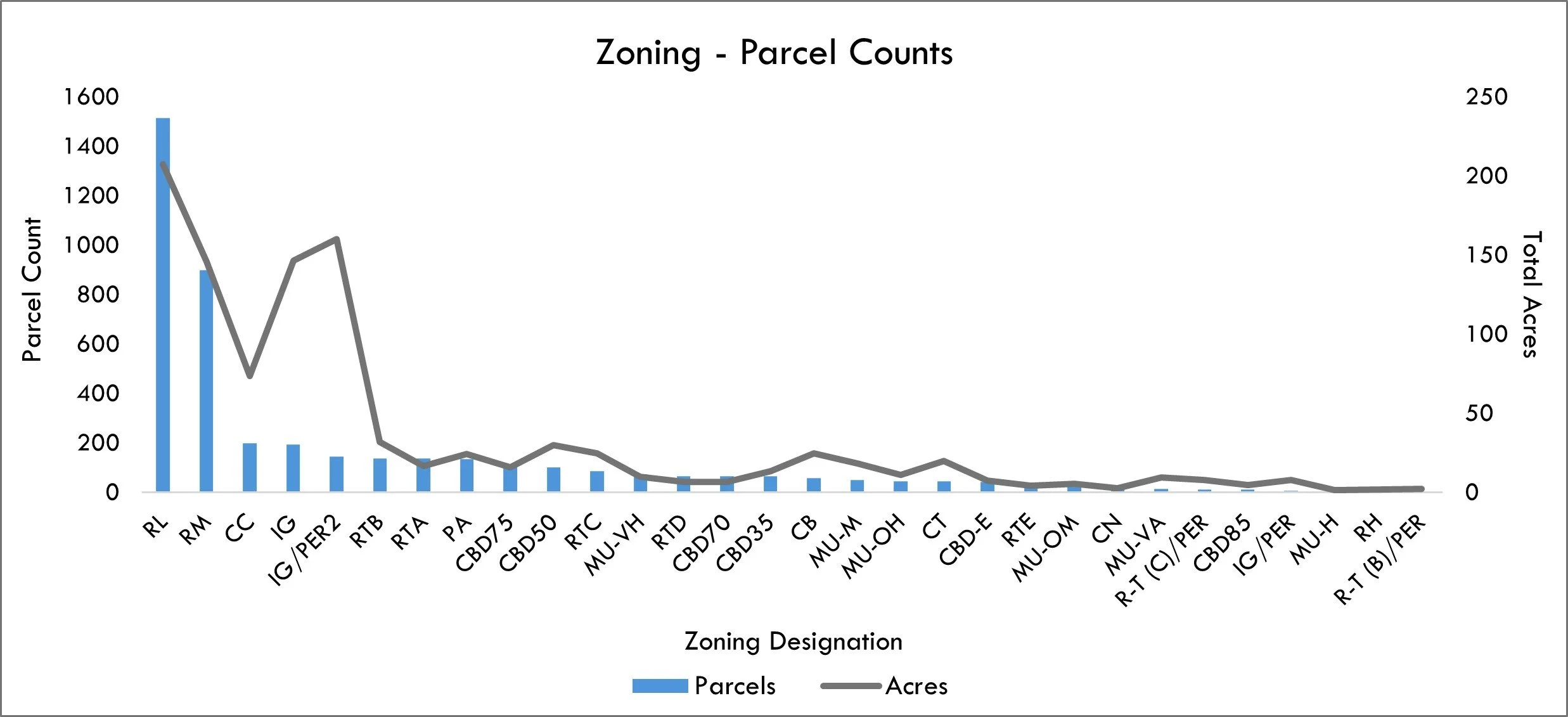

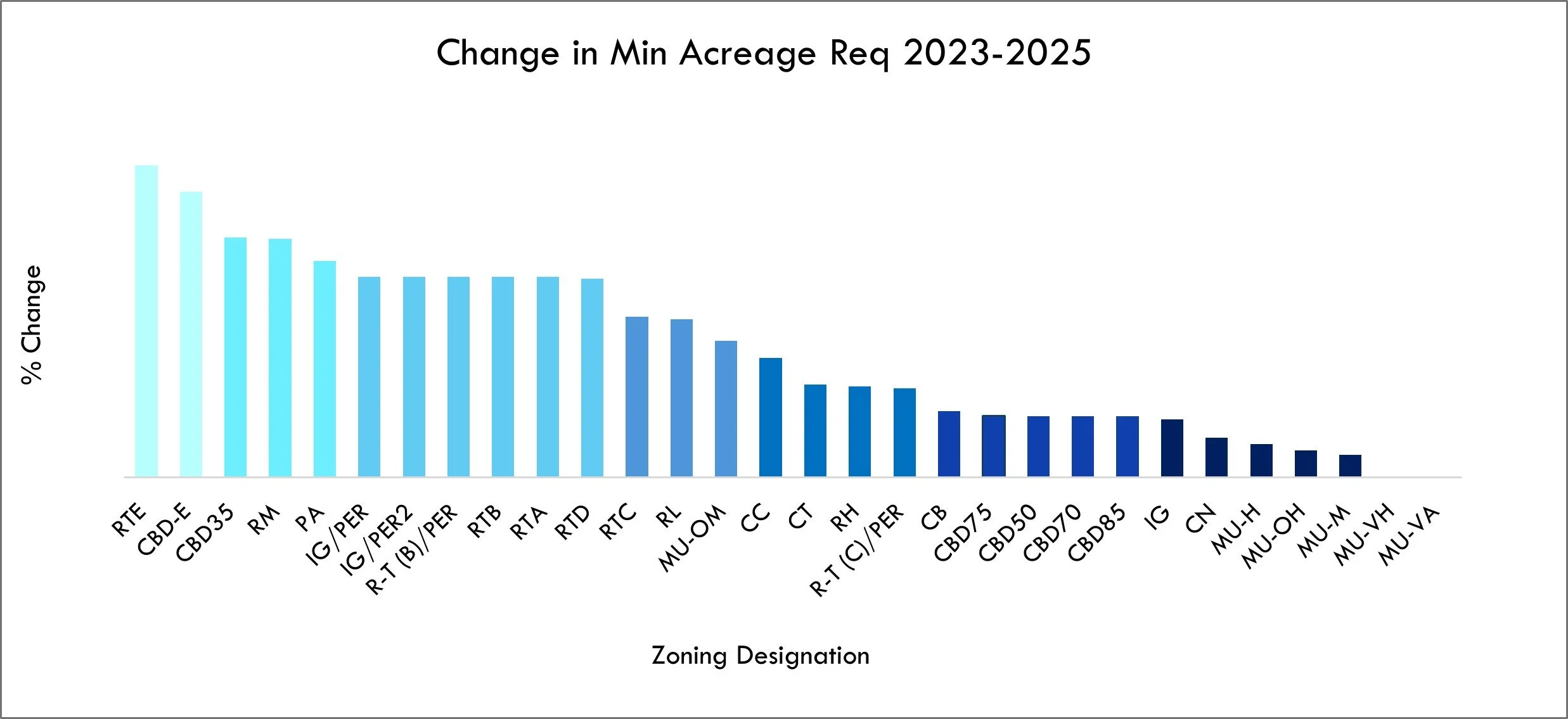

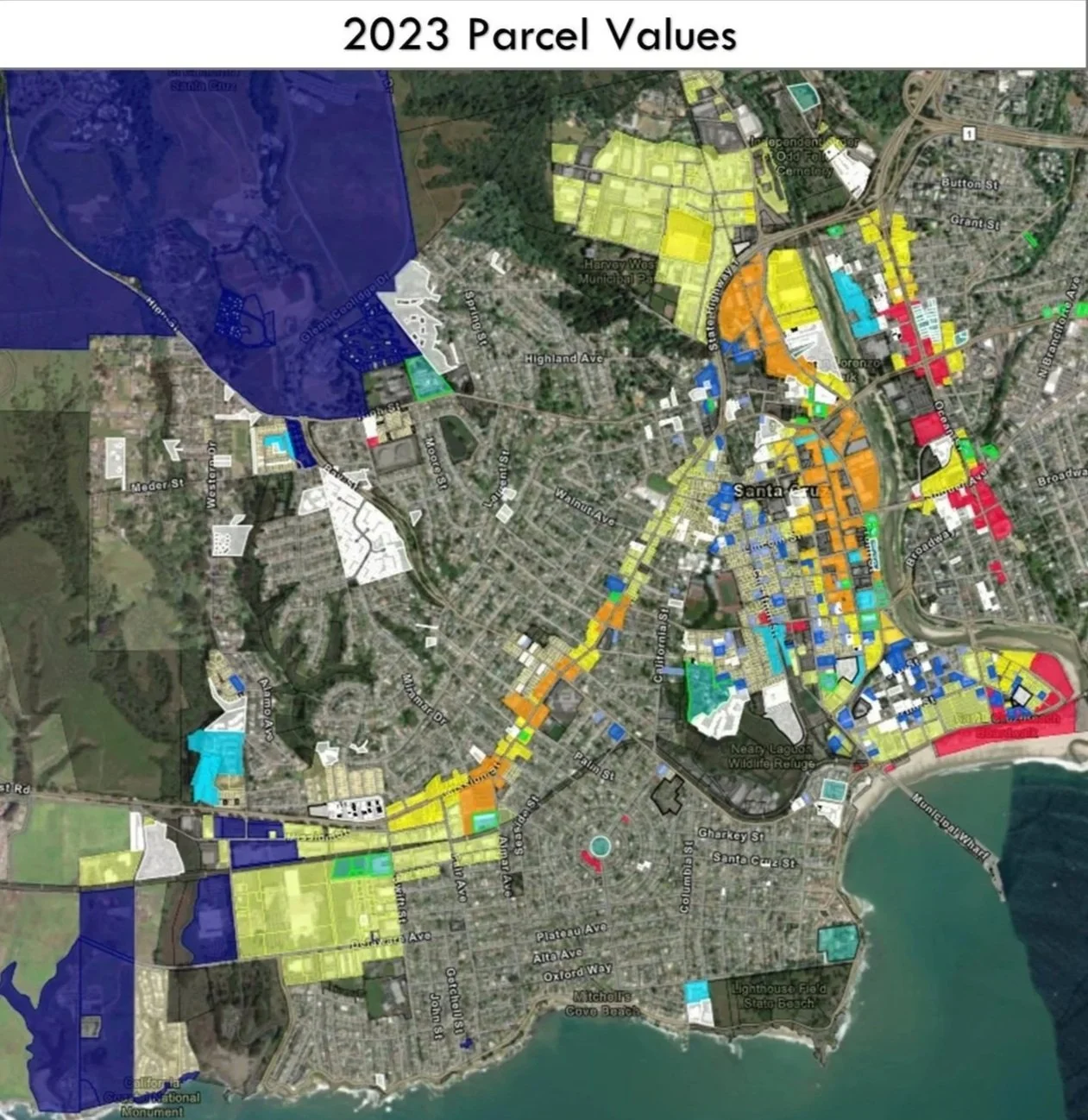

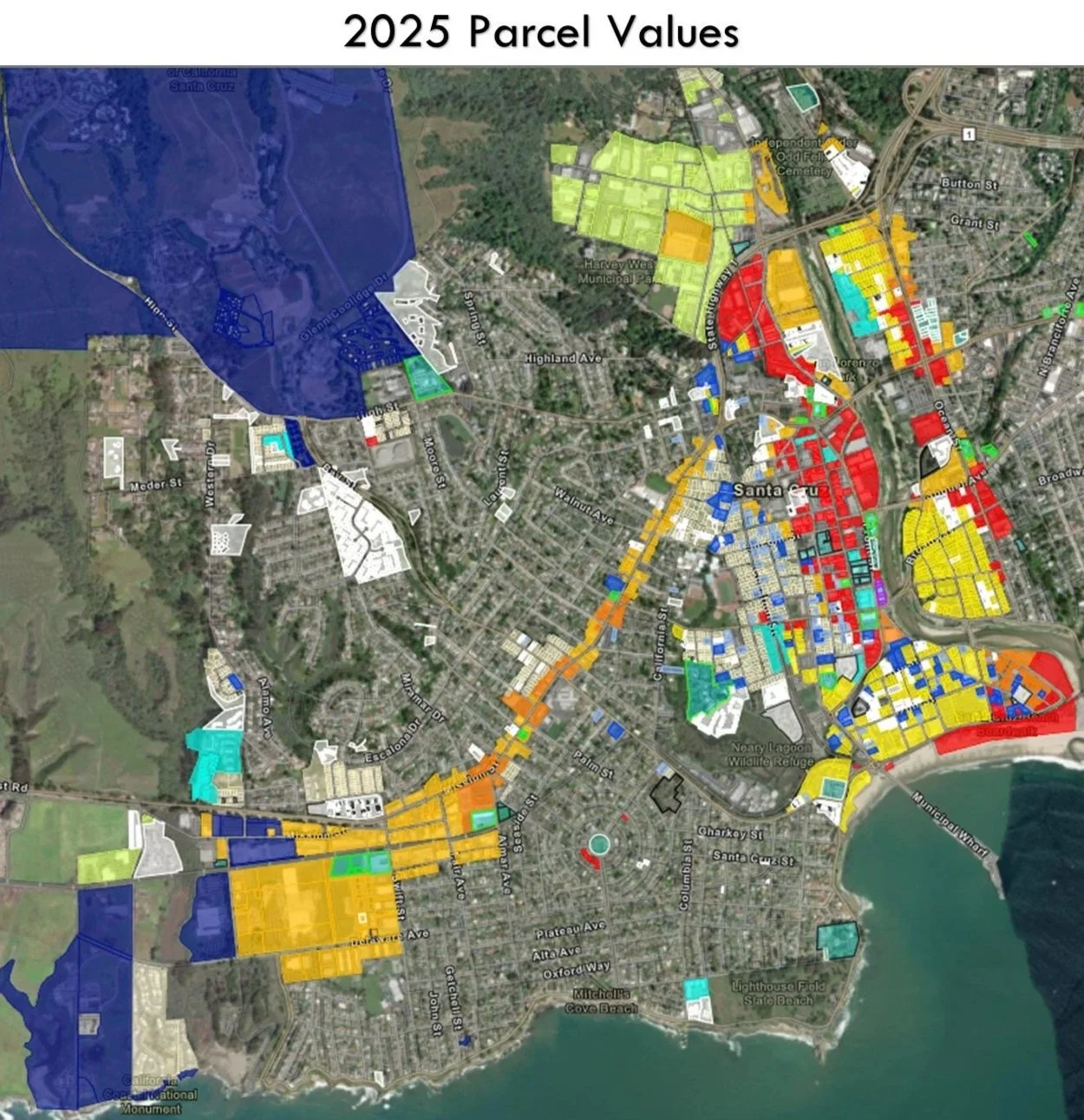

Most investors and developers who have explored California markets are aware of the broad changes since 2019, but few firms have taken the time to fully appreciate the value created in 2024 and 2025. In Santa Cruz for example, there is only one market rate project in the development pipeline utilizing a density bonus over the 50% threshold introduced in 2023. It seems clear that equity and sponsors have not yet taken the steps to fully capitalize on the most recent wave of legislative value creation.

New Developer Protections

Since the introduction of SB 330 in 2020, state legislators have continued to address the development vulnerabilities that come with the lengthy and complex entitlement process inherent in California projects. Adding incentives did little to curb the power of local communities to kill deals by exploiting technicalities and weaponizing paperwork delays. As a result, many of the bills introduced in the past several years have been designed to close these commonly exploited loopholes. In the last several years, affordable projects across the state have seen more traction. Today, cities are modifying their design standards to align with state incentives, and communities known for opposing new housing development are considering automatic approval processes for certain projects to avoid appearing powerless in front of angry residents. Progress is being made.

While affordable housing has seen the most dramatic gains in process streamlining, new bills addressing efficiencies and loopholes in fee structure, rezoning, permitting, CEQA review, approval timelines, and other aspects of the entitlement process have been introduced to protect ALL housing projects meeting the pre-determined guidelines. I’ve listed some of the more important recent legislative steps below.

Process Streamlining/CEQA-Laundering Protections

SB 35 - Streamlined Approval Process for Affordable Housing - Effective Jan 1, 2018

SB 330 - Housing Crisis Act of 2019 - Effective Jan 1, 2020

AB 130 - Budget Trailer - Effective Jun 30, 2025

SB 131 - Public Resources - Effective Jun 30, 2025

AB 2011 - Affordable Housing and High Roads Jobs Act of 2022 - Effective Jul 1, 2023

Rezoning and Adaptive Reuse Pathways

SB 6 - Middle Class Housing Act of 2022 - Effective Jan 1, 2024

AB 529 - Adaptive Reuse Projects - Effective Jan 1, 2024

AB 1490 - Adaptive Reuse for Affordable Housing - Effective Jan 1, 2024

AB 2243 - AB 2011 Commercial Site Housing Expansion - Effective Jan 1, 2025

Enhanced Density Bonus Law (DBL) Incentives

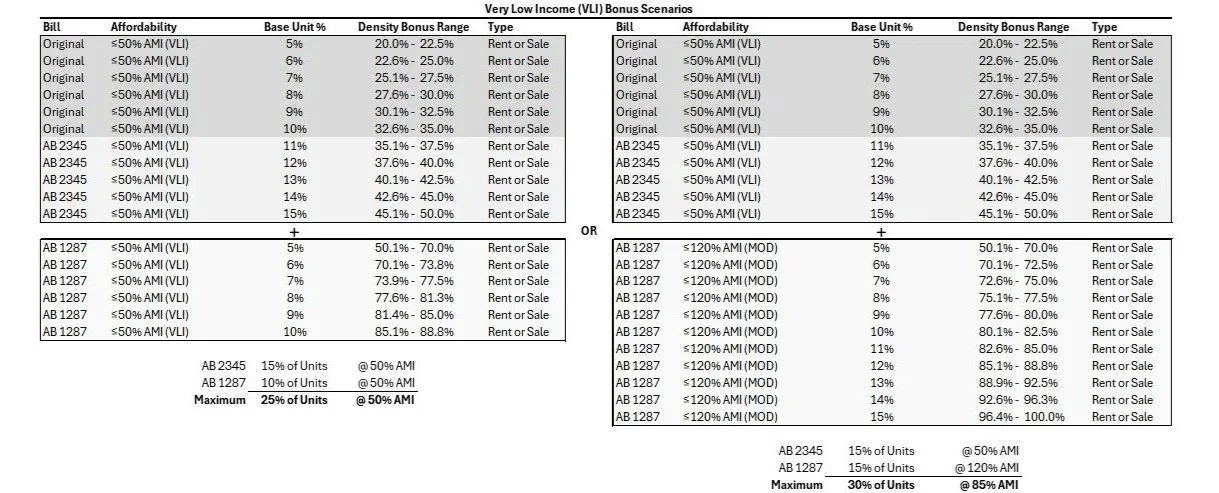

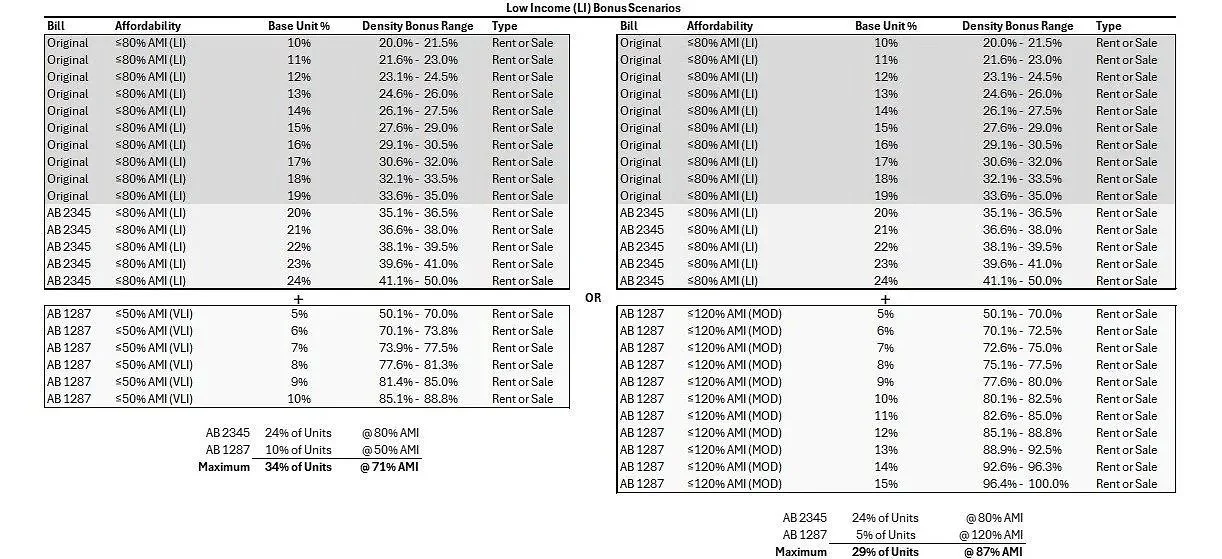

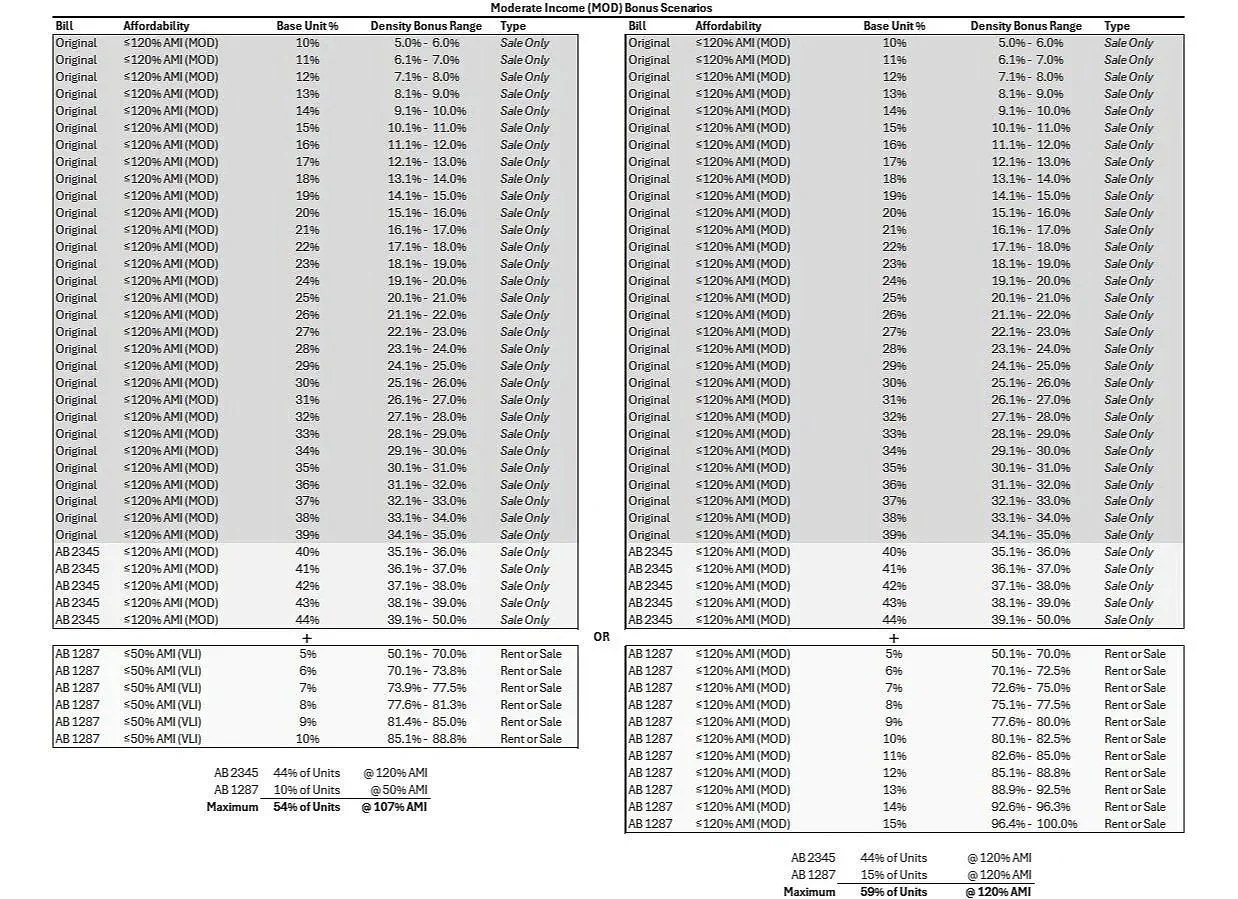

As most are aware, significant modifications have been made to the California DBL since the introduction of AB 2345 in 2021. In an effort to overcome the increased costs and additional risk of California housing development, the state has continued to add additional density incentives and concessions (not part of this analysis) for projects that include an affordable housing component equal to at least 5% of base density. The most recent modifications to the 1979 California law are listed below.

AB 2345 - Density Bonus Law Enhancements - Effective Jan 1, 2021

AB 2334 - DBL VMT Area and 100% Affordable Enhancements - Effective Jan 1, 2023

AB 1287 - DBL Stackable Bonus Incentives and Additional Concessions -Effective Jan 1, 2024

AB 3116 - Additional Density Bonus Benefits for Student Housing - Effective Jan 1, 2025

AB 2694 - Extenstion of DBL Benefits to Elderly Residential Care Facilities - Effective Jan 1, 2025